2024 Form 1040 Schedule Enforcement

-

admin

- 0

2024 Form 1040 Schedule Enforcement – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D The IRS chose to step up enforcement of taxes on crypto by placing a question at the .

2024 Form 1040 Schedule Enforcement

Source : www.btcpa.netACA IRS Reporting Overview 2024 | Word & Brown

Source : www.wordandbrown.com2024 Form 1040 ES

Source : www.irs.govBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.comInternational Tax Group | Phoenix AZ

Source : www.facebook.comIRS to Require Electronic Filing for ACA Reporting in 2024

Beyond Pro Consultants LLC | Chicago IL

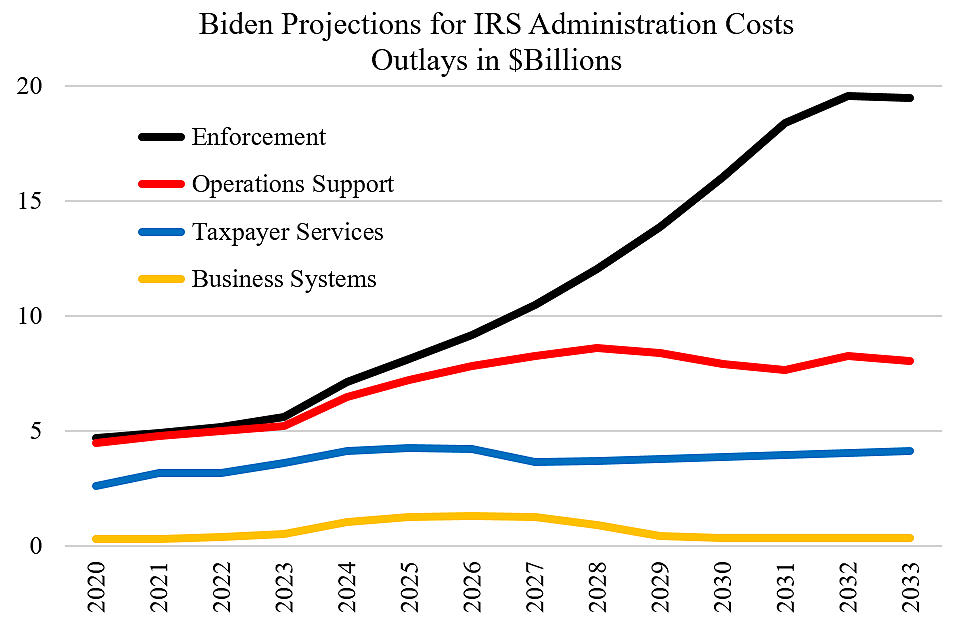

Source : m.facebook.comBiden’s IRS Enforcement Budget to Skyrocket | Cato at Liberty Blog

Source : www.cato.orgHolland & Knight on X: “#Tax atty Lee Meyercord will speak at this

Source : twitter.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.com2024 Form 1040 Schedule Enforcement FinCEN Compliance – Summer 2023 BE 12 Reporting & Beneficial : The 1099 forms are sent to you by clients you work for. Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” . Recent changes to Form 1040 mean different filing options for seniors. Get the facts about eligibility and reporting for this new version of Form 1040-SR. Recent changes to Form 1040 mean .

]]>

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)