Unreimbursed Business Expenses 2024au

-

admin

- 0

Unreimbursed Business Expenses 2024au – Unreimbursed business expenses are an itemized schedule A tax deduction that can reduce your tax liability. The IRS only allows you to deduct business expenses not reimbursed by your employer. . The IRS also requires that you itemize these unreimbursed business expenses when filing your tax returns using IRS Form 1040. Add up the unreimbursed expenses. Calculate the total amount of the .

Unreimbursed Business Expenses 2024au

Source : medicalpartnership.usg.eduACCEO Logivision on LinkedIn: ACCEO Logivision Self Checkout

Source : www.linkedin.comAU Employee Reimbursement Form AU/UGA Medical Partnership

Source : medicalpartnership.usg.eduPDP | Spreadsheet | NorCal Premier

Source : norcalpremier.comBusiness Office AU/UGA Medical Partnership

Source : medicalpartnership.usg.eduCyril Hosejka Hoppenot Finance Lead Paris 2024 Olympics

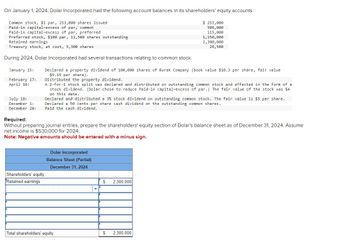

Answered: On January 1, 2024, Dolar Incorporated… | bartleby

Source : www.bartleby.comDefinity on LinkedIn: #teamdefinity #itsbetterhere #jobopportunities

Source : ca.linkedin.comPerspectives on Business Management with Jeff Sotok, Executive VP

Source : www.metalformingmagazine.comFoundever auf LinkedIn: Abo newsletter foundever

Source : de.linkedin.comUnreimbursed Business Expenses 2024au Hotel Tax Exempt Form REQUIRED for In State Travel AU/UGA : Rajeev Dhir is a writer with 10+ years of experience as a journalist with a background in broadcast, print, and digital newsrooms. Janet Berry-Johnson is a CPA with 10 years of experience in . Previously, employees could claim an itemized deduction for unreimbursed business expenses that exceeded 2% of their adjusted gross income. This included any work-related expenses for business you .

]]>